First off, we want to qualify our remarks in this article by disclosing that neither of our educational or professional backgrounds includes formal training as actuaries or statisticians.

Wisconsin Workers' Compensation Experience Modification Rate (“The Mod”)

For many businesses in Wisconsin, workers' compensation constitutes the lion’s share of their property & casualty insurance expense. Rightly so, as people are a business’s most valuable asset. Like everything else these days, it seems like the cost of insurance is increasing over almost all insurance lines, but there are some exceptions. In the last 10 years, business owners have invested a great deal to protect their employees, prevent workplace accidents, and improve the safety culture of their businesses. As a result of these investments, Wisconsin employers have seen a consistent drop in incident rates and, in turn, workers' compensation rate reductions even though the costs associated with workers' compensation claims have been rising faster than inflation. This is great news for business owners and consumers alike!

If your workers' compensation policy is written on a guaranteed cost basis and generates $7,500 or more in annual premium, your workers' compensation policy will qualify for an experience modification and the Wisconsin Compensation Rating Bureau (WCRB) will calculate and apply an experience modification to your WC policy. For companies with multi-state operations, a similar rating is generated by the National Council on Compensation Insurance (NCCI). Most people are familiar with the concept of experience rating in relation to auto insurance (i.e. you get in an accident or file a claim, and your rates will go up for a period of time). Statistically speaking if you are a brand new employer, or your losses are average compared to other employers in your industry, your WC experience modification is 1.00 and the quoted rates used to calculate your WC premium are not credited or debited.

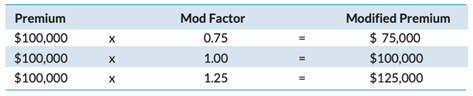

On the other hand, if your experience is better than average and you earn a credit experience modification rate of .75 for example, then the WC rates on your policy are discounted by 25%. Conversely, if your experience is worse than average, you earn a debit experience modification rate of 1.25 for example, then the WC rates on your policy are increased by 25%. In this example that’s a 50% cost delta. For more information on how the mod is calculated – click here.

The Denominator Effect

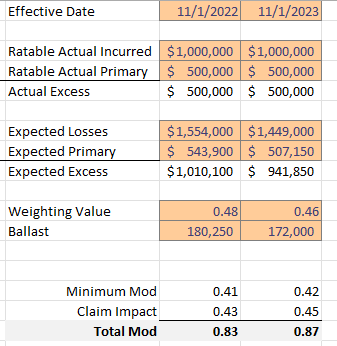

So, what is the denominator effect and how does it affect your business? Let’s start with some basics. The experience modification rate is calculated by taking your actual WC losses divided by your expected WC losses over a 3-policy-year rolling horizon time frame. The denominator in that equation is calculated by taking the audited annual payrolls for that 3-year rating window multiplied by the respective WC class code rates and then multiplied again by the WCRB’s expected loss rates for the policy year being rated. The expected loss rates are closely correlated to the WC class code rates used to calculate your workers' compensation premium.

PAYROLL x CLASS CODE RATE x EXPECTED LOSS RATE = EXPECTED LOSS $

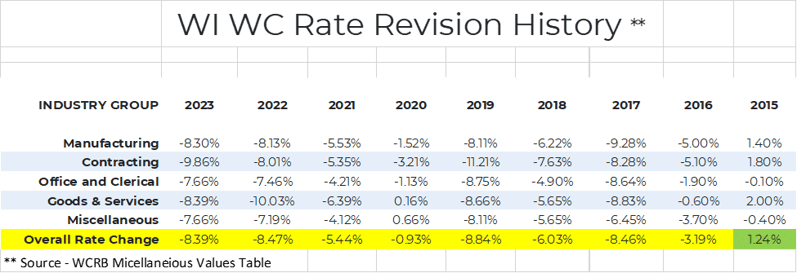

As you can see from the table below, the work comp Overall Rate Change has decreased year over year since 2016. In fact, the last time there was an increase in the Overall Rate Change was in 2015.

The denominator effect applies to all businesses with an experience modification on their WC policy, but this is a case where size matters. As companies grow, so too do payrolls (and the costs associated with them like WC premium). If WC rates are declining, the expected loss rates naturally follow suit. In this environment, it becomes more difficult to earn credit experience modifications (below 1.00) on a guaranteed work comp policy.

In effect, some policyholders’ experience modifications are penalized by the denominator effect. Depending on a business’ appetite for risk, and/or businesses that develop a work comp premium of $250,000 or more, it becomes worthwhile to consider alternative risk financing work comp programs. Some examples of alternative risk financing plans include (but are not limited to): retrospective rating (retro plans), insurance captives, and large deductible plans. These types of WC policies don’t utilize the experience modification as part of the pricing of their WC policies and are not priced based on rates set by the WCRB. Instead, insurance company actuaries calculate a WC loss based upon only the past loss experience of that policyholder and, in many cases, these programs offer a cash flow advantage. It is important to note, however, that experience modification rates may still be used and evaluated during the underwriting process (and thus is still an important metric to monitor) or at times as a prequalification process to doing business.

In effect, some policyholders’ experience modifications are penalized by the denominator effect. Depending on a business’ appetite for risk, and/or businesses that develop a work comp premium of $250,000 or more, it becomes worthwhile to consider alternative risk financing work comp programs. Some examples of alternative risk financing plans include (but are not limited to): retrospective rating (retro plans), insurance captives, and large deductible plans. These types of WC policies don’t utilize the experience modification as part of the pricing of their WC policies and are not priced based on rates set by the WCRB. Instead, insurance company actuaries calculate a WC loss based upon only the past loss experience of that policyholder and, in many cases, these programs offer a cash flow advantage. It is important to note, however, that experience modification rates may still be used and evaluated during the underwriting process (and thus is still an important metric to monitor) or at times as a prequalification process to doing business.

Maybe now is the time for your company to consider an alternative risk financing work comp program…it’s now up to you.

COMMENTS