Dissecting the recently passed 400+ page tax overhaul can be daunting, but there is one change that should have all homeowners taking a second look at their current insurance program.

Provisions of the newly passed tax bill eliminate a tax deduction for uninsured casualty losses from natural disasters like fire, earthquake, hurricane, and flood. A deduction could only be claimed for disasters that the President declares a federal emergency, such as hurricane Harvey.

That means personal losses from wildfires, earthquakes, floods, and other natural disasters (also including theft) would no longer qualify as a tax deduction. Previously, homeowners could deduct losses that were uninsured if they amounted to more than 10% of their incomes. The deductions were applicable to homes, personal property, and vehicles that were damaged or destroyed. The deduction was not applicable for losses covered by insurance.

In 2015, more than 72,000 people filed casualty or theft deductions resulting in $1.6 billion in claims according to the IRS Statistics of Income Division.

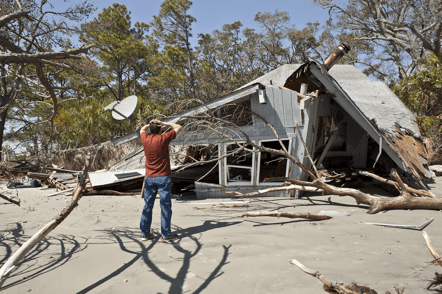

So, what does this mean for homeowners? If there are 5 homes flooded in your neighborhood instead of 500, this will be overlooked as a natural disaster. If you have no flood coverage in your insurance policy you will not only be out the financial value of your home, but you will not be able to deduct that loss when you file your taxes. This creates an increased financial burden in an already challenging and stressful time.

This change in the tax bill puts more onus on the homeowner to be properly protected. Coverages like earthquake, flood, and hurricane are standard exclusions in most homeowner’s insurance policies. It is the responsibility of the homeowner, now more than ever, to have the proper coverage in place for their exposures.

Now is a good time to take a second look at what is covered and, more importantly, what is excluded on your policy.

COMMENTS