OVERVIEW

Welcome to our second annual Workers' Compensation Seminar, taking place on September 24th from 8:00 AM to 1:00 PM.

Breakfast snacks and lunch will be provided.

New this year:

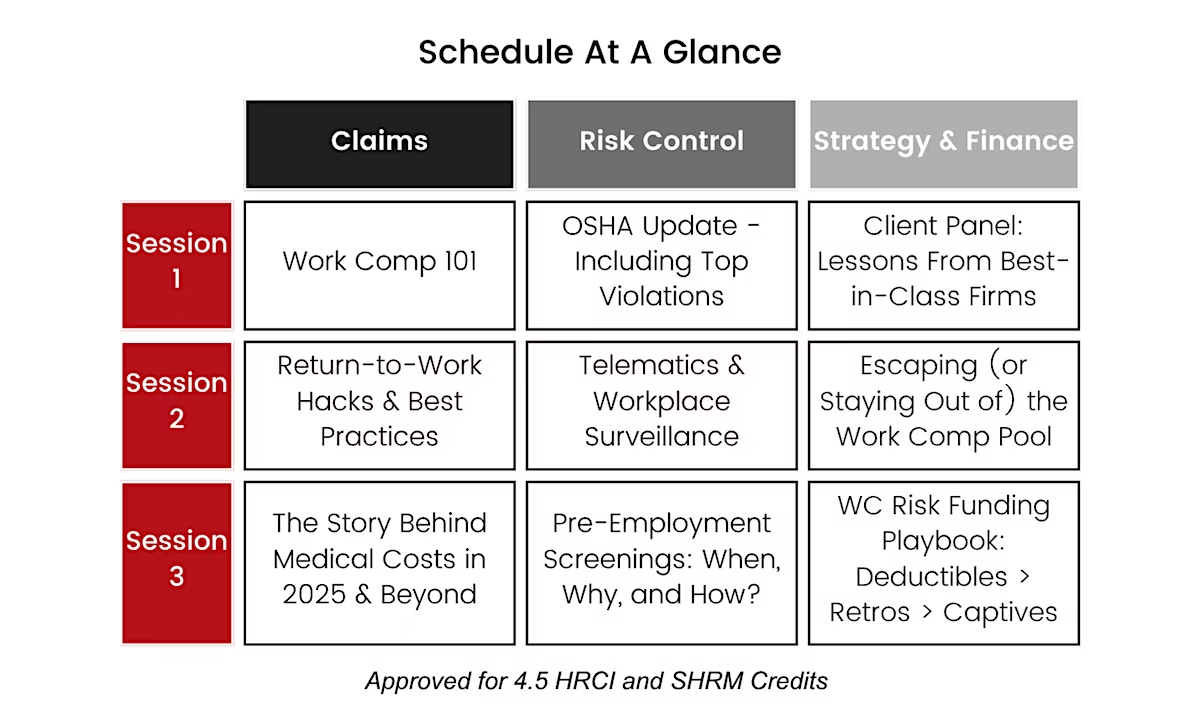

- In order to accommodate more sessions, we have created three distinct learning tracks: Claims, Risk Control, and Strategy & Finance.

- You can customize your sessions based on your interests by selecting your sessions at the registration page.

- We have moved our location to the DoubleTree by Hilton Madison East to accommodate more guests.

- Approved for 4.5 HRCI and SHRM CE Credits

AGENDA

- Schedule Overview

- Claims Track

- Risk Control Track

- Strategy & Finance Track

8:00 - 8:30 AM

Registration, Breakfast Snacks, Coffee and NetworkingREGISTRATION, COFFEE & NETWORKING

Sign-in, mingle, and enjoy breakfast snacks and coffee with fellow attendees8:30 - 9:30

SESSION IChoose from:

- Work Comp 101

- OSHA Update - Including Top Violations

- Client Panel: Lessons from Best-in-Class Firms

9:30 - 9:40

Break I9:40 - 10:40

SESSION II

Choose from:

- Return-to-Work Hacks and Best Practices

- Telematics & Workplace Surveillance

- Escaping (or Staying Out of) the Work Comp Pool

10:40 - 10:50

BREAK II10:50 - 11:50

SESSION IIIChoose from:

- The Story Behind Medical Costs in 2025 & Beyond

- Pre-Employment Screenings: When, Why and How?

- WC Risk Funding Playbook: Deductibles, Retros and Captives

11:50 - 1:00

Lunch & Networking8:30 - 9:30

Presented by: Jason Hiller, WCLSWork Comp 101

Back by popular demand, Jason Hiller will cover the basics of Workers' Compensation catered specifically to employers and their teams.

This session will discuss:

- Introduction to Workers’ Compensation

- Claims Process

- Benefits and Coverage

- Requirements for a Compensable Claim

9:40 - 10:40 AM

Speakers: Jason Hiller, WCLSReturn-to-Work Hacks and Best Practices

It is critical to have a return-to-work program established in your business prior to experiencing a worker's compensation claim. Help your business create a sense of stability for your employees as well as reduce costs on your overall workers' compensation program.

This session will cover:

- The real cost of lost time injuries, and how to stop the bleeding

- Establishing your company’s philosophy and policy for return to work

- Techniques for working with medical providers during the claims process

- Creative light duty solutions

10:50 - 11:50 AM

Presented By: Mike Johnson, CEBS, GBDSThe Story Behind Medical Costs in 2025 & Beyond

Join Mike Johnson as he sets the stage for what's driving medical costs today from regulatory shifts impacting pricing and transparency to cost-containment strategies.

This session will discuss:

- Legislative updates to Employee Benefit Plans

- Comparisons from Fully Funded vs. Self Funded Plans

- What's New in 2025

- Looking Ahead: What Employers Should be Watching

- Open Discussion

8:30 - 9:30 AM

Speakers: Rick Barton, CSP, ARM

OSHA Update - Including Top Violations

Start your morning at the Work Comp Seminar with the need-to-know on OSHA Updates. From the new SST guidelines, documentation, to the most common violations, Rick Barton will give insight into how you can keep your risk down and your compliance up.

This session will cover:

- A 101 overview of OSHA's latest regulatory updates

- SST Targeting and more

- Compliance and Risk Exposure

- Top OSHA Violations: PPE, Hazard Communication and more

9:40 - 10:40 AM

Speakers: Ken AlderdenTelematics and Workplace Surveillance

The growing role of technology in the workplace leads to both solutions and obstacles for risk managers and operations teams. Ken Alderden will outline the benefits and risks to implementing the more common uses of telematics, workplace surveillance, and other technological tools for your workforce.

This session will cover:

- What is and What is Not Telematics

- Benefits and Key Drivers

- Risks and Legal Considerations

- What is the Right Fit for Your Business - Striking the Balance

10:50 - 11:50

Moderator:

Jason Hiller, WCLS

Guest Speakers:

Scott Law, PT, DPT, CEAS I | Athletico

Bob Gregg | Boardman Clark

Pre-Employment Screenings: When, Why, and How

Does your business need pre-employment screenings? Thoughtful and compliant hiring can set you up for success from day one with a new employee. Join Scott Law and Bob Gregg as they outline the when, why, and how of pre-employment screenings.

This session will cover:

- The "When": Timing, Purpose, and Practical Tips

- The "Why": Protecting Your Workplace and Industry Norms

- The "How": Legal Requirements, Reliable Screening Partners, and Best Practices

8:30 - 9:30 AM

Moderator: John Oliver

Client Experts:

- Sara Kjome, Woodman's Markets

- Matt Shelton, Haas Construction

- Amanda Jabs, Food Fight

Client Panel: Lesson from Best-in-Class Firms

Building a high functioning work comp and employee safety program takes time, talent, and tenacity…with plenty of bumps and bruises along the way. In this panel discussion with business leaders from across Wisconsin, you’ll hear about how their organizations got to where they are today.9:40 - 10:40 AM

Speakers: John OliverEscaping (and Staying Out Of) the Work Comp Pool

The Workers’ Compensation Pool is a costly place to land—and for many employers, it’s not clear how they got there in the first place. In this session, John Oliver will clarify how the Pool works, how your experience mod influences eligibility, and what steps employers can take to manage risk and regain access to the voluntary market.

Expect a practical breakdown of:

- What is the Work Comp Pool and why it exists

- The cost impact: Voluntary market vs. the Pool

- How frequency affects your experience mod—and your Pool status

- Wisconsin-specific red flags and thresholds

- High-level strategies to work your way back out

10: 50 - 11:50 AM

Speakers: Erik Hausmann, CIC, CRM, CRISWC Risk Funding Playbook: Deductibles, Retros and Captives

Most companies pay a fixed premium for Workers’ Compensation coverage—but that’s not the only option. For firms with strong safety performance or predictable losses, alternative funding models like deductibles, retros, and captives can offer more control and potential cost savings. In this session, we’ll break down how these programs work, who they’re right for, and what to watch out for.

Topics include:- How alternative Workers’ Comp programs differ from traditional insurance

- Pros and cons of deductibles, retros, and captives

- When it might make sense to explore a new approach

- Common misconceptions about these programs

- What kind of companies are best positioned to make the switch

Our Speakers

- John Oliver

- Jason Hiller

- Rick Barton, CSP, ARM

- Ken Alderden

- Mike Johnson, CEBS

- Bob Gregg

- Scott Law, PT, DPT, CEAS I

Director of Client Services, Risk Management | Principal

John Oliver joined the team in 2022 as Manager of Property & Casualty Claims. Prior to joining Hausmann Group he spent 15 years working for a handful of insurance carriers including Church Mutual, QBE, and NSI. John’s career focus has been on providing risk management and claim mitigation support to clients of all shapes and sizes. He’s been fortunate to collaborate with a wide array of insurance professionals in Claims, Risk Control, Underwriting, and Marketing.

John graduated from the University of Wisconsin School of Business with double majors in Risk Management, Insurance and Real Estate, and Urban Land Economics. He’s a Certified Authority in Workers’ Compensation. In his role as manager, he leads the claims service team and collaborates with the HG Risk Control department to deliver the best experience for clients. John is passionate about leading teams, creating efficiencies, and learning as much as he can.

John describes himself as an extreme extrovert who tries to never sit still for too long. He loves spending time with his family, friends, and neighbors. He enjoys going on walks with his wife Samantha, his kids Josephine and Vincent, and his dog Gilman. He likes doing projects around the house, playing volleyball, brewing beer, and staying busy with yard games.

Additionally, John is passionate about accessibility to high-quality childcare as well as diversity and inclusion efforts in his community. He serves as a board member for the Playing Field, a Madison-based nonprofit early childhood learning center, and, as a proud alumnus, he supports the Posse Foundation scholars on campus at UW-Madison.

Claims Resolution Strategist - Worker's Compensation

Jason joined the team in 2022 as a Claims Resolution Strategist specializing in Worker’s Compensation. Before joining Hausmann Group, he was the Director of Safety & Compliance at a multi-state temporary staffing/recruiting, HR Consulting & PEO organization. His 15+ years of experience in workers’ compensation and return-to-work strategies has given him a knack for walking the tightrope between protecting the organization and doing what is right, while also treating employees with respect and empathy. Workers’ compensation has always been one of Jason’s favorite focus areas, and he’s excited to bring his experience and knowledge to HG clients. Fun fact: He can come up with a light duty solution for (practically) any scenario.

Jason thrives in a space where he is helping clients navigate the claims process and working toward favorable outcomes on all ends. He appreciates being an extension of a client’s team by taking work off their plate to allow them to focus on their business and sleep better at night.

Manager of Risk Control Services | Principal

Rick has more than 20 years of experience in safety and risk control, working with clients in many industries including Construction, Mining, Trucking, Manufacturing, and Hospitality. He specializes in assessing risk for the clients of Hausmann Group to reduce loss potential. Through safety assessments and loss analysis, Rick develops solutions which include safety management techniques, training, and engineering. Additionally, he has been asked to speak at local and national safety conferences on topics such as "How to Manage Safety on a Jobsite," and "What it takes to be a Safety Leader."

Rick is an Authorized Instructor of OSHA Regulations Construction and General Industry Regulations. He is an active member of the Wisconsin Transportation Builders Association (WTBA), Associated Builders & Contractors (ABC), the Wisconsin chapter of The American Society of Safety Engineers (ASSE), and the Association of General Contractors (AGC). He is also on the Advisory Board of the Safety Studies Department at the University of Wisconsin—Whitewater.

Rick is an avid boater and enjoys sharing time on the water with family and friends. His children are spread across 4 U.S. states, so he and his wife are often traveling to visit them. He also has attended more than 160 games home and away to see his beloved Green Bay Packers play.

Risk Control Consultant

Ken joined Hausmann Group in 2022 with over 30 years of experience in the insurance safety field. He has worked both on the carrier and agency side, which gives him a unique perspective into the ins and outs of safety at companies both large and small. Ken focuses on Construction safety in particular, working with clients on fleet safety, FMCSA issues, and large property fire protection.

When Ken encounters a problem, he prides himself on making practical suggestions to improve safety that not only are effective at reducing risk, but also are practical to the business owners with their investment of time and money. He states, “Often there are alternatives to conventional safety practices that are overlooked. I would like to think my clients would say I enjoy providing common sense solutions.”

You can find Ken landscaping, tinkering with machines in his garage or spending time with his family when he is not in the office. He loves to do anything outdoors and has coached baseball, softball, basketball, and soccer over the years.

Ken has a B.S. in Occupational Safety from UW-Whitewater and is an OSHA Outreach Trainer for Construction Safety.

Vice President of Employee Benefits and Sales Strategy | Principal

Mike joined Hausmann Group in 2018 and brings a wealth of employee benefits knowledge and experience to the team. He recognizes that employee benefits are often one of the top three expenses for a business, but benefits also directly impact employees’ everyday lives. From his point of view, the world of insurance has become seen as insensitive to the needs of employees and their families. To combat this, he aims to create a win-win situation for employees and employers.

Mike knows that the best problem he can solve is one he can identify proactively and transparently. By looking 2-3 years out and addressing any type of cost or compliance concerns head on, he is able to help his clients and their employees achieve their goals. He works to build repeatable processes that address his clients’ benefit costs, compliance, and communications.

Besides employee benefits, one thing Mike can’t stop talking about is his family. He enjoys cooking weekend breakfasts for his wife, Shannon, and their three children, Cade, Atalie, and Quinn. He also enjoys fishing, hunting, and golfing in the great outdoors, and is a big Wisconsin sports fan. “Wisconsinite” describes Mike to a "t."

Mike is proud to be recognized as a member of the In Business Magazine “40 under 40.” He gives back to the community through his role as Vice President of Membership for the Greater Madison Area Society for Human Resource Management, while also participating on the Advisory Board for Wisconsin Recruiters.

Attorney | Boardman Clark

Bob Gregg is an employment relations attorney with more than 30 years of experience representing clients on complex issues. Bob litigates a wide variety of employment cases on behalf of employers, including discrimination, wage, and hour, FMLA, ADA, unfair discharge, contracts, privacy, and more. His main emphasis is helping employers achieve enhanced productivity, creating positive work environments, and resolving employment problems before they generate lawsuits. Bob conducts proactive management seminars throughout the United States to teach supervisors how to recognize issues and avoid liability.

Bob’s career has included canoe guide, carpenter, laborer, Army Sergeant, professional beer taster, social worker, educator, business owner, Equal Employment Opportunity officer, and employment relations attorney. Bob is a member of the Society for Human Resource Management, the National Speakers Association and served on the board of directors for the Department of Defense Equal Opportunity Management Institute Foundation.

Bob is nationally recognized for his work on respectful workplaces in education, employment and service provision, and has helped numerous public and private employers. As Chief Equal Rights Officer for the Wisconsin Personnel Commission, he was responsible for implementing some of the first anti-harassment and anti-bullying policies and practices in the United States. He is a Nationally recognized authority on workplace issues and has authored numerous articles on practical employment practices.

Bob’s practice also has a special focus in documentation issues. He is retained to conduct high level, sensitive investigations for both public and private sector organizations. Bob trains HR staff, security personnel, and civil investigators in the concepts of properly investigating employment issues.

Work Comp Program Manager | Athletico Physical Therapy

Scott Law earned his Bachelor of Science in Kinesiology from the University of Wisconsin–Milwaukee in 2002 and his Doctorate in Physical Therapy from Marquette University in 2005. He began his career with Athletico in 2005 and has since held progressive roles including Staff Clinician, Clinic Manager, and currently, Workers’ Compensation Program Manager. In this role, he oversees workers’ compensation operations across Wisconsin and Northern Illinois.

Scott specializes in helping injured workers safely return to the workplace through individualized work conditioning programs and functional capacity evaluations. He also partners with employers on-site as a Certified Ergonomic Assessment Specialist (CEAS I), developing proactive ergonomic solutions to identify risk factors, reduce workplace injuries, and manage workers’ compensation costs effectively.

.png)